Third consecutive drop in approvals in November follows disastrous ‘mini budget’

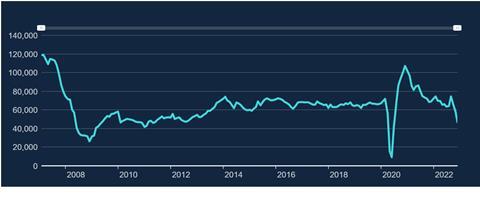

Mortgage approvals fell to their lowest level since the height of the covid pandemic in November according to the latest data from the Bank of England.

While the official numbers from Threadneedle Street showed that the value of actual lending in November only dipped slightly on October’s figures, the figures showed that the number of approvals for lending – a measure of future loans – was at its lowest ebb since June 2020 in the immediate aftermath of the first covid lockdown.

The Bank of England said that 46,075 mortgages were approved for house purchase in November, a fifth down on the previous month. The fall marks the third consecutive monthly drop in mortgage approvals, and leaves the metric 38% below its August high point of 74,425.

The numbers show the impact of former chancellor Kwasi Kwarteng’s catastrophic “mini budget” on the housing market, which saw mortgage interest rates soar to an average of above 6% for two-year fixed rate deals, their highest for 14 years, in the following weeks. Mortgage interest rates have reduced in recent weeks but remain well above levels seen prior to the “mini budget”.

Aside from the brief collapse in housing transactions seen during the first covid lockdown, the November figure published today is the lowest monthly mortgage approvals number since April 2011, when the housing market was still recovering from the global financial crisis.

The Bank of England said the “effective” interest rate – the actual interest rate paid – on newly drawn mortgages increased by 26 basis points to 3.35% in November. Gross mortgage lending decreased by 7% from £27.7bn in October to £25.7bn in November.

Founder and CEO of easyMoney, Jason Ferrando, said the figures appeared to be a “cause for concern given the doom and gloom that has enveloped the UK property market in recent months”.

However, he added that he expected a “return to the pre-pandemic norm” in the year ahead, “albeit a rather bumpy landing, rather than the first signs of a property market collapse”.

No comments yet