South east housing developer says it is yet to secure a waiver for £13.6m loan

A subsidiary of troubled AIM-listed developer Inland Homes has breached banking covenants regarding a £13.6m loan from HSBC and is yet to secure a waiver, the firm has admitted.

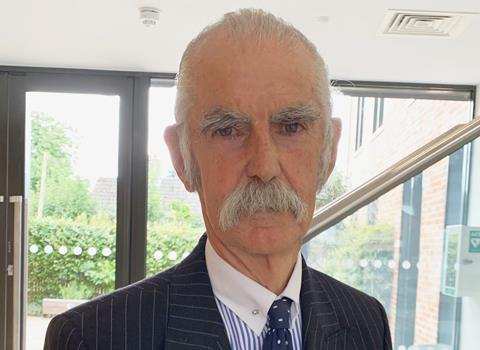

The company, which is now run by former Gleeson boss Jolyon Harrison after a deal was reached to bring the veteran chief executive in over the summer, said it was in “active discussions” with HSBC regarding securing a waiver.

The breach regards a loan made to Inland Homes Developments Ltd, a development subsidiary of Inland Homes plc, by the bank, which is guaranteed by the parent company.

Inland said in a statement that “Inland Homes Developments Ltd is in breach of certain historic and forward looking covenants in relation to a debt facility of £13.6m provided to that company”.

The announcement comes after Inland warned of a possible breach on August 30, stating that it was likely given it was considering “possible provisions to be made against certain asset values in its accounts with its auditors”.

The £181m turnover firm is yet to publish accounts for the year to September 30 2022, which were due in February but have been delayed three times amid a slew of profit warnings and an investigation into “related party issues” that led to the resignation of board members.

Inland declined to answer questions on the likelihood of being able to secure a waiver to the covenant breach, or the implications for the firm if the loan is ultimately called in. Inland said a “further announcement will be made in due course.”

Inland initial attempt to replace founder Stephen Wickes, who resigned after a profit warning last September, failed when former Galliard boss Don O’Sullivan resigned after just 41 days in the role.

Shares were suspended in the firm in April after it failed to publish results to the required deadline.

No comments yet